Minervini's Volatility Contraction Pattern (VCP): A Step-by-Step Guide to High-Growth Potential

Mark Minervini's trading success, with reported returns exceeding 300% in some years, isn't based on luck. He leverages a powerful technical analysis strategy known as the Volatility Contraction Pattern (VCP). This guide provides a detailed, actionable approach to identifying and trading VCPs, emphasizing risk management throughout. Remember, while this strategy offers high reward potential, it also carries substantial risk. To learn more about Minervini's background, check out his impressive net worth here.

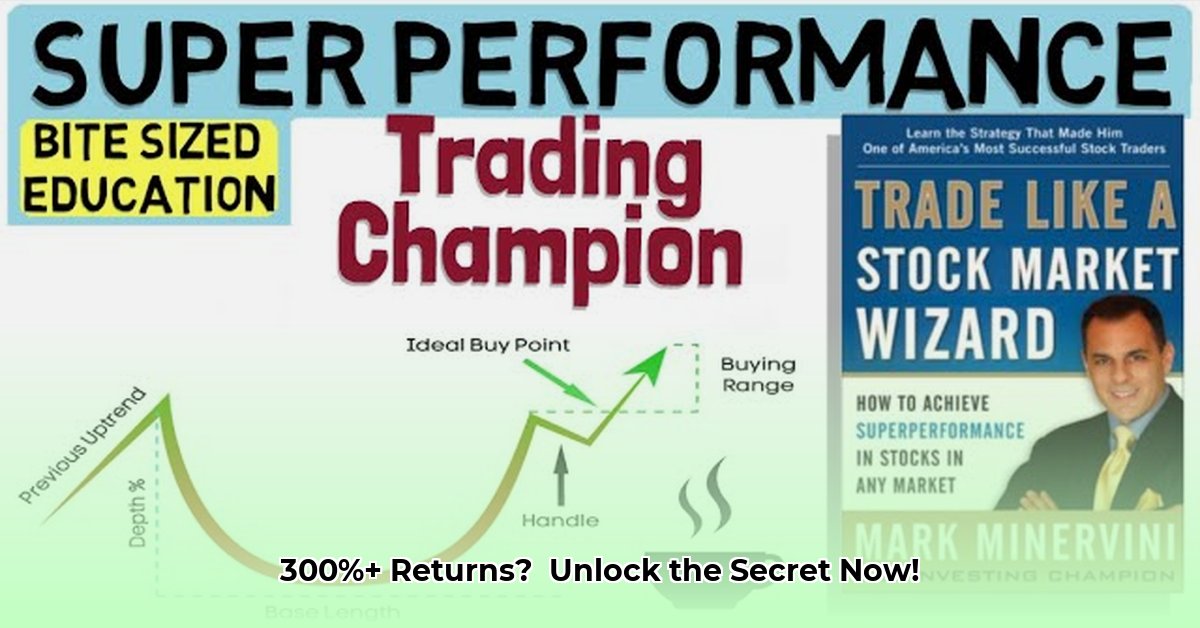

Understanding the VCP: A Tightly Wound Spring

The VCP identifies stocks undergoing a period of consolidation (a sideways price movement within a defined range) after a strong upward trend. This consolidation, often characterized by decreasing volatility and trading volume, is analogous to a tightly wound spring, poised for a powerful breakout. Minervini's approach combines this technical analysis with fundamental research, focusing on fundamentally sound companies showing strong growth potential. Are you ready to learn how to spot these "springs" before they launch?

Identifying Winning Stocks: A Practical, Step-by-Step Approach

Finding VCPs requires patience and skill. This structured approach breaks down the process:

Identify Upward Momentum: Begin by screening for stocks showing a clear, established upward trend. This initial bullish movement is foundational.

Recognize the Consolidation: Spot periods of sideways price movement within a relatively tight range. This period of reduced volatility indicates the "contraction" phase of the VCP. Notice the decreased trading volume during this phase.

Utilize Technical Indicators: Employ tools like the Ichimoku Cloud (a versatile technical indicator providing insights into support, resistance, and momentum) to confirm the VCP pattern. These tools provide additional confirmation.

Conduct Thorough Fundamental Analysis: Don't solely rely on charts. Investigate the company's underlying business. Is it an industry leader? Does it have a compelling growth narrative? Solid fundamentals are crucial.

Look for Confirmation Signals: Look for further indicators confirming an imminent breakout, such as increased trading volume, or positive news. These signals provide critical confirmation.

Navigating the Risks: A Realistic Assessment

Minervini's strategy, while potentially lucrative, involves significant risk. High rewards inherently accompany high risk. Here's a breakdown of potential pitfalls:

| Risk Factor | Likelihood | Potential Impact | Mitigation Strategies |

|---|---|---|---|

| Market Downturn | High | Very High | Diversification, stop-loss orders, position sizing |

| Misidentification of VCP | Moderate | Moderate | Thorough analysis, multiple confirmation signals, backtesting |

| Overconfidence | Moderate | Moderate | Simulated trading, strict adherence to trading plan |

| Lack of Diversification | High | Very High | Diversify across multiple stocks and asset classes |

The concentrated nature of the strategy amplifies both potential profits and losses. Thorough risk mitigation is paramount.

Building Your Action Plan: From Knowledge to Execution

Mastering the Minervini VCP strategy is a journey. This action plan guides you:

Education is Key: Devote time to mastering technical and fundamental analysis. Numerous online resources and courses are available.

Backtesting is Crucial: Before using real capital, rigorously backtest your strategy using historical stock data. This allows you to refine your approach virtually.

Discipline and Adherence: Stick to your well-defined trading plan. Avoid emotional trading decisions; let your strategy guide your actions.

Prioritize Risk Management: Always use stop-loss orders to protect against significant losses. Never risk more capital than you are prepared to lose. Position sizing is essential.

The Minervini VCP strategy offers high-reward potential. However, success demands meticulous planning, disciplined execution, and a deep understanding of market dynamics. Remember –consistent application of this strategy is critical for success. Are you ready to start practicing?